The Ghana Gold Board (GoldBod) And The Strategic Realignment Of National Resource Governance: A Macroeconomic And Comparative Analysis

The establishment of the Ghana Gold Board, commonly referred to as Goldbod, under the Ghana Gold Board Act, 2025 (Act 1140), represents perhaps the most significant institutional overhaul of the Ghanaian mining sector since the late 1980s. For decades, the artisanal and small-scale mining (ASM) sector, which currently employs over one million Ghanaians and supports nearly five million livelihoods, operated within a fragmented and porous regulatory environment. This informality facilitated systemic leakages, with estimates suggesting that over 30% of ASM gold output was diverted through informal or under-invoiced channels, resulting in annual losses exceeding $1.1 billion in taxes, royalties, and foreign exchange (FX). The persistent disconnect between Ghana’s status as a leading global gold producer and its recurring foreign exchange crises necessitated a move toward centralisation. This report, prepared by the Africa Sustainable Energy Centre (ASEC), provides an exhaustive analysis of Goldbod’s legal framework, its macroeconomic performance in 2025, a comparative assessment against global peers, and strategic recommendations for long-term sustainability.

The Structural and Historical Context of Gold Sector Leakages

The necessity for Goldbod is rooted in a historical paradox where physical gold production failed to translate into liquid foreign exchange for macroeconomic stabilisation. Gold has consistently accounted for more than 50% of total merchandise export receipts over the last decade, yet periods of peak production frequently coincided with reserve depletion and cedi instability. This phenomenon is analysed through the lens of the effective FX capture ratio, which measures the share of gross gold export value entering the domestic financial system. Prior to 2025, the capture ratio for ASM gold was significantly below unity, indicating that gold was being used as a capital flight mechanism rather than a national asset.

The historical legislative framework, starting with the Minerals and Mining Law of 1986 (PNDC Law 153), attempted to regularise "Galamsey" but limited it to indigenes and residents with no use of sophisticated technology.4 By 1989, PNDC Law 218 sought further regularisation, yet the sector remained prone to informality. The failure of these earlier regimes culminated in the 2021 crisis, where the introduction of a 3% withholding tax on unprocessed gold led to a collapse in official ASM exports—falling from 39.3 tonnes in 2020 to a mere 3.4 tonnes in 2021 This historic failure proved that the ASM market is highly sensitive to pricing signals and that non-competitive state intervention drives gold into the shadows.

Institutional Architecture of Act 1140 and the Dissolution of PMMC

Act 1140 marks a transformative era by dissolving the Precious Minerals Marketing Company (PMMC) and transferring its expanded mandate to Goldbod. Goldbod is now the sole legal body responsible for regulating the buying, aggregation, assaying, refining, and exportation of gold, particularly from the ASM sector. Under this new legal regime, all former export licenses issued by the PMMC or the Ministry of Lands and Natural Resources became invalid as of May 1, 2025, unless reauthorised by the Board.

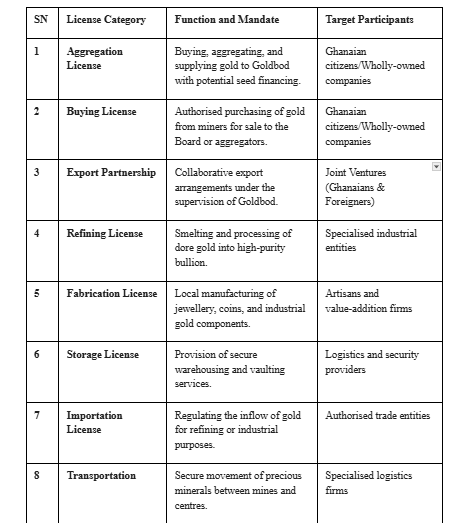

The Licensing and Regulatory Framework

The new framework centralises oversight through an exhaustive licensing regime. Section 26 of Act 1140 mandates that any person seeking to engage in the gold trading or marketing industry must obtain a license from Goldbod. The Act identifies some distinct categories of business activities requiring specific authorisation, as detailed in the comparative table below:

A critical component of this reform is the mandatory exit of foreign nationals from the local gold trading market. As of April 30, 2025, all foreign traders were required to exit the local market; however, they may still operate as off-takers, purchasing directly from the Board's certified pool or through joint ventures with Ghanaian aggregators. This policy aims to ensure that the primary value of the gold trade remains within the domestic economy while strengthening the local currency by conducting all transactions in Ghana cedis at the Bank of Ghana reference rate.

Macroeconomic Performance and the 2025 Economic Rebound

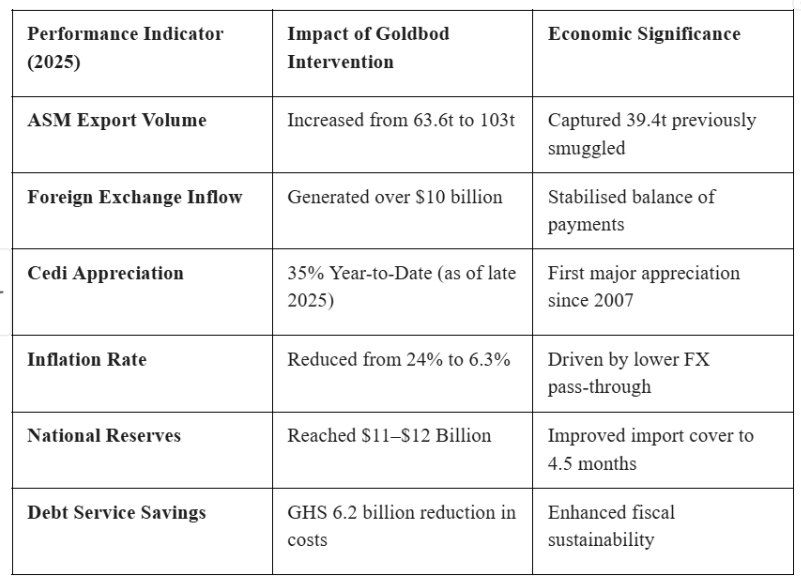

The impact of Goldbod’s centralised system was immediate and measurable. Within its first year, the Board effectively recovered approximately one-third of the volume previously lost to smuggling. Officially recorded ASM gold exports rose from 63.6 metric tonnes in 2024 to 103 metric tonnes by the end of 2025. This represents an additional 39.4 tonnes of gold captured within the formal economy, translating into $3.8 billion in additional foreign exchange inflows.

Impact on National Reserves and Currency Stability

The centralisation of the gold trade has been a cornerstone of the Bank of Ghana’s reserve accumulation strategy. Total gold holdings stood at 30.53 tonnes in December 2024 and climbed to 38.04 tonnes by October 2025. This 24.6 % increase provided the necessary buffer to stabilise the exchange rate and ease inflationary pressures.

Below are some performance indicators of Goldbod.

These gains have significant ripple effects. The appreciation of the cedi resulted in direct fiscal savings on external debt servicing and Independent Power Producer (IPP) payments exceeding GHS 12.6 billion ($1.142 billion). The inflow of non-debt foreign exchange also reduced the country’s reliance on costly external borrowing, saving an estimated $266 million to $380 million in annual interest costs.

Mechanism of the Policy Cost

To attract gold into formal channels, Goldbod and the BoG utilise a "premium" pricing model. Purchases are often made at near-retail or spot prices to match the rates offered by illicit traders, while the inflows are booked at lower interbank rates. For instance, Goldbod may offer a bonus of GHS 50 per ounce over the standard rate to minimise the incentive for miners to engage with smugglers. While this creates a paper loss of roughly 2.5 percent of the gold’s value, the resulting macroeconomic stabilisation delivers far greater value. Economists have calculated a benefit-cost ratio of 18 to 1, meaning that for every dollar "lost" in trading, the Ghanaian economy gained eighteen dollars in broader benefits

Liquidity and Delivery Risks

While the trading loss is often a paper transaction, the "delivery risk" remains a genuine concern. As of December 2025, reports indicated that Goldbod had under-delivered gold relative to BoG funding by over GHS 3.5 billion. This liquidity exposure means the central bank is bearing the commodity price risk; if global gold prices were to fall before delivery, the BoG could face realised losses that impair its capital and policy credibility. Addressing this structural flaw by tightening delivery timelines and rationalising fee structures is essential for the Board’s long-term sustainability.

Global Comparative Analysis: Lessons from Guyana, Tanzania, and South Africa

Ghana’s decision to centralise the gold trade is not unique, and its success depends on learning from the failures and successes of similar institutions worldwide.

The Guyana Gold Board: A Warning of Inefficiency

The structure of the Ghana Gold Board has been described by some critics as a "plagiarised" version of the Guyana Gold Board (GGB), established in 1982. The GGB also holds a monopoly on buying and exporting gold. However, the Guyanese experience serves as a cautionary tale: the GGB recorded massive losses, including $9.7 billion in 2013 alone due to price manipulation, lack of transparency, and corruption. In Guyana, the compulsory sale of gold to the government eventually harmed the economy by fostering an even larger black market when state prices failed to match international benchmarks.

Tanzania: The Mineral Trading Centre Hubs

In 2019, the Tanzanian government established 28 mineral-trading centres to formalise ASM and reduce smuggling. These hubs are government-controlled and allow small-scale miners to trade gold directly without having to travel to major cities. Like Ghana, Tanzania mandates that mining firms allocate at least 20% of production for sale to the central bank. While this has increased transparency, the "top-down" approach in Tanzania has faced criticism for excluding local communities from the legislative process and failing to provide adequate technical support to miners.

South Africa: Regulatory and Commercial Separation

South Africa maintains a more mature governance model where regulatory and commercial activities are strictly separated. The Department of Mineral Resources and Energy oversees regulation, while state-owned and private entities operate independently within that framework.23 The South African Diamond and Precious Metals Regulator (SADPMR) handles licensing and export approvals, ensuring that the country’s resources are exploited in the national interest without the inherent conflicts of interest seen in a single-agency monopoly.

Governance Risks and the "Elite Capture" Concern

While Goldbod has achieved significant short-term wins, policy think tanks have raised alarms regarding governance and the risk of political capture. The Africa Centre for Energy Policy (ACEP) argues that buying gold at a premium is an admission of weak law enforcement and official complicity in smuggling. If smuggling can only be stopped by outbidding illicit actors, it suggests that the state’s borders and oversight mechanisms remain fundamentally porous.

Furthermore, the consolidation of regulatory and commercial powers within Goldbod creates a conflict of interest. As the sole licensor of market participants and a major commercial buyer, Goldbod must regulate the very entities it competes with for supply. This structure risks deterring private investment and limiting market trust, as private aggregators may fear biased enforcement or non-transparent pricing mechanisms. The "Democracy Capture" report by CDD-Ghana further warns that such institutional monopolies can be manipulated to serve partisan interests under the guise of national governance.

The Technological Frontier: Blockchain and Traceability

To address these transparency concerns, Goldbod is preparing to launch a blockchain-based track-and-trace system by the end of 2026. This system is a legal requirement under Section 31X of the Gold Board Act and is designed to ensure that every gram of gold exported from Ghana is traceable to its mine of origin.

The digital system will capture data from the point of production to the point of sale, creating an immutable record that enhances accountability. This initiative is crucial for aligning Ghana with international standards, such as the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas. Goldbod’s Responsible Sourcing policy already rejection human rights abuses, child labour, and conflict financing, but the blockchain rollout will provide the technical verification needed to maintain access to premium global markets.

Value Addition and Industrialisation: Beyond Raw Exports

A key objective of Act 1140 is to promote value addition. Goldbod is empowered to regulate the local fabrication of jewellery, coins, and industrial gold products. This is part of a broader strategy to transform Ghana from a mere supplier of raw mineral feedstocks into a regional manufacturing hub.

Objective Stance and Strategic Recommendations from the Africa Sustainable Energy Centre (ASEC)

The Africa Sustainable Energy Centre (ASEC) concludes that the Ghana Gold Board has been a successful macroeconomic stabilisation tool in its inaugural year. However, to ensure that the Board does not become a fiscal burden or a conduit for corruption, ASEC recommends the following strategic adjustments:

1. Institutional Separation of Powers

The government should reform the Goldbod Act to separate regulatory oversight from commercial trading. The authority to issue licenses and enforce compliance should be returned to the Minerals Commission or an independent regulator, while Goldbod functions as a purely commercial state-owned enterprise (SOE). This would eliminate conflicts of interest and foster a competitive, transparent market for private aggregators and refiners.

2. Fiscalization of Policy Costs

The "trading losses" incurred by the Bank of Ghana should be clearly identified as quasi-fiscal policy costs and explicitly funded through the national budget. This would enhance the transparency of the central bank’s balance sheet and enable a more accurate assessment of the Board’s economic impact.

3. Strengthening Delivery Oversight

Goldbod must address the issue of under-delivery. The Bank of Ghana should introduce firm delivery timelines and penalties for delays in the supply of physical gold. Furthermore, the Board should diversify its supply chain by engaging more of the 51 licensed Self-Finance Aggregators (SFAs) to reduce institutional risk.

4. Acceleration of Value Addition

While the focus has been on reserve accumulation, the Board must prioritise the development of local refining and fabrication capabilities. Encouraging the domestic use of gold as a store of value through the issuance of "Gold Coins" for the general public would help further reduce the "dollarisation" of the economy.

5. Community-Centred Formalisation

Learning from the Tanzanian experience, Goldbod must ensure that its formalisation efforts are participatory. This includes deep engagement with traditional authorities and district assemblies to resolve land disputes and ensure that the benefits of the gold trade reach the mining communities themselves.

Conclusion

The emergence of Goldbod represents a watershed moment for Ghana’s mineral governance. By centralising the ASM gold trade, the state has demonstrated its ability to capture substantial value that was previously lost to the informal economy. The $3.8 billion in formalised foreign exchange generated in 2025 is an achievement that has single-handedly provided a foundation for currency stability and inflation control. However, the challenges of transparency, institutional conflict of interest, and the fiscal sustainability of premium pricing remain.

The future of Goldbod lies in its ability to evolve from a "crisis intervention" agency into a transparent, technologically advanced, and commercially efficient national institution. By integrating blockchain traceability and separating its regulatory powers, Goldbod can ensure that Ghana’s gold remains a blessing rather than a source of illicit flow and environmental ruin. The Africa Centre for Sustainable Energy remains committed to monitoring these developments, providing the objective analysis needed to safeguard Ghana’s energy and mineral future..1

Works cited

Ghana Gold Board (GoldBod) is formalising the ASM Sector and boosting Ghana's Gold production. - Ghana Gold Board https://goldbod.gov.gh/ghana-gold-board-goldbod-is-formalising-the-asm-sector-and-boosting-ghanas-gold-production/

Ghana Gold Board (GoldBod) Explained: What Foreign Gold Traders Need to Know in 2025

https://clintonconsultancy.com/2025/04/16/goldbod-ghana-export-law-for-foreign-traders/

Evaluating the Macroeconomic Effects of the Ghana Gold Board (GOLDBOD),https://cdn.modernghana.com/files/1122026102523-1j041p5cbw-finalthe-macroeconomic-benefits-of-goldbod11126.pdf

GoldBod's History, Why Bawa Rock Is the Sole Aggregator, and the Path to Safeguard Our Environment, Communities, and Economy - Modern Ghana, https://www.modernghana.com/news/1461922/goldbods-history-why-bawa-rock-is-the-sole-aggre.html

GoldBod: Spot-Price Buying Is Key to Curbing Gold Smuggling, accessed https://goldbod.gov.gh/goldbod-spot-price-buying-is-key-to-curbing-gold-smuggling/

Navigating Ghana's Gold Trading and Marketing Industry Reforms Under the Ghana Gold Board Act 2025 (ACT 1140) - Legal Ink, https://www.legalinkonline.com/the-goldbod/

B P & - B&P Associates, accessed January, https://bpaghana.com/wp-content/uploads/2025/05/GoldBoard_2025.pdf

New GoldBod Law in Ghana: What It Means for Foreign Gold Traders, https://clintonconsultancy.com/2025/04/15/ghana-goldbod-law-foreign-traders-guide/

Ghana Enacts The Gold Board Act, 2025 (Act 1140) To Regulate ..., https://legalstonesolicitorsllp.com/publications/ghana-enacts-the-gold-board-act-2025-act-1140-to-regulate-gold-export-trading-and-marketing-understanding-the-legal-framework-and-reforms/

GOLDBOD: LOSS OR NO LOSS? - Modern Ghana,https://www.modernghana.com/news/1462739/goldbod-loss-or-no-loss.html

GoldBod delivers 18x value: Ghana gains $3.8bn as smuggling falls sharply, https://www.gbcghanaonline.com/news/goldbod-delivers-18x-value-ghana-gains-3-8bn-as-smuggling-falls-sharply/2026/

From smuggling to stability: How GoldBod pulled 39 tons of gold into Ghana's formal economy,https://www.gbcghanaonline.com/news/from-smuggling-to-stability-how-goldbod-pulled-39-tons-of-gold-into-ghanas-formal-economy/2026/

GoldBod drives Ghana's gold reserves to 38.04 tonnes, accessed January 14, 2026, https://goldbod.gov.gh/goldbod-drives-ghanas-gold-reserves-to-38-04-tonnes/

GoldBod CEO Sets Record Straight on Bank of Ghana Loss Claims, https://goldbod.gov.gh/goldbod-ceo-sets-record-straight-on-bank-of-ghana-loss-claims/

Does Goldbod owe BoG US$214m, or has BoG lost US$214m? A policy and financial risk analysis - MyJoyOnline, https://www.myjoyonline.com/does-goldbod-owe-bog-us214m-or-has-bog-lost-us214m-a-policy-and-financial-risk-analysis/

GoldBod rejects IMF claims of $214m loss in BoG Gold-for-Reserve program - Ghana Web,https://www.ghanaweb.com/GhanaHomePage/business/GoldBod-rejects-IMF-claims-of-214m-loss-in-BoG-Gold-for-Reserve-program-2015167

Is the IMF lying about Ghana's GoldBod? - THE SCARAB - Bright Simons, https://brightsimons.com/2025/12/is-the-imf-lying-about-ghanas-goldbod/

GoldBod is a Very Serious Error in Judgement - The Ghanaian Chronicle, https://thechronicle.com.gh/goldbod-is-a-very-serious-error-in-judgement/

The Mineral Industry of Tanzania in 2019 - USGS Publications Warehouse https://pubs.usgs.gov/myb/vol3/2019/myb3-2019-tanzania.pdf

Inside Tanzania's mineral trading hubs - Mining Technology, accessed January https://www.mining-technology.com/features/inside-tanzanias-mineral-trading-hubs/

Draft IGF Case Study | Transforming Artisanal and Small-Scale Gold ..., https://www.igfmining.org/wp-content/uploads/2025/02/igf-asgm-case-study-draft-02-2025.pdf

Artisanal and small-scale mining in Tanzania and health implications: A policy perspective,https://pmc.ncbi.nlm.nih.gov/articles/PMC10070382/

Strengthening gold sector governance through institutional separation: Reforming GoldBod in line with modern extractive sector principles - The Business & Financial Times,https://thebftonline.com/2026/01/14/strengthening-gold-sector-governance-through-institutional-separation-reforming-goldbod-in-line-with-modern-extractive-sector-principles/

Regulations – SADPMR, https://www.sadpmr.co.za/service/regulations-2/

GoldBod, BoG Buying Gold at Premium Price to Curb Smuggling Signals Policy Failure - ACEP Boss Says | The High Street Journal, https://thehighstreetjournal.com/goldbod-bog-buying-gold-at-premium-price-to-curb-smuggling-signals-policy-failure-acep-boss-says/

Strengthening Gold Sector Governance Through Institutional Separation - Modern Ghana, https://www.modernghana.com/news/1461809/strengthening-gold-sector-governance-through-insti.html

Ghana think tank warns of elite capture of democracy - WADR, https://wadr.org/ghana-think-tank-warns-of-elite-capture-of-democracy/

GoldBod Set to Deploy Blockchain System to Trace Every Gram of Gold by 2026. https://goldbod.gov.gh/goldbod-set-to-deploy-blockchain-system-to-trace-every-gram-of-gold-by-2026/

Ghana Gold Board to launch blockchain tracking system by end of 2026 - Mariblock, https://www.mariblock.com/ghana-gold-board-to-launch-blockchain-tracking-system-by-end-of-2026/

Goldbod's track-and-trace system commences in first quarter of 2026- CEO hints, accessed https://goldbod.gov.gh/goldbods-track-and-trace-system-commences-in-first-quarter-of-2026-ceo-hints/

Ghana to deploy blockchain track-and-trace system to curb gold smuggling, accessed https://www.ghanaweb.com/GhanaHomePage/business/Ghana-to-deploy-blockchain-track-and-trace-system-to-curb-gold-smuggling-2010825

OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas | Global Mercury Partnership - UNEP, accessed https://www.unep.org/globalmercurypartnership/resources/guidance/oecd-due-diligence-guidance-responsible-supply-chains-minerals-conflict-affected

Responsible Sourcing - Ghana Gold Board, accessed January https://goldbod.gov.gh/responsible-sourcing/

Responsible mineral supply chains - OECD, https://www.oecd.org/en/topics/sub-issues/due-diligence-guidance-for-responsible-business-conduct/responsible-mineral-supply-chains.html

Ghana Gold Board: Home, https://goldbod.gov.gh/

Black star, green minerals – governance and opportunities in Ghana's critical minerals sector | Global Mining Review, https://www.globalminingreview.com/mining/23122025/black-star-green-minerals-governance-and-opportunities-in-ghanas-critical-minerals-sector/

Envisioning a Ghana Beyond Gold - MIIF, https://miif.gov.gh/envisioning-a-ghana-beyond-gold/

Economists urge Ghana to treat GoldBod as a strategic policy https://www.gbcghanaonline.com/news/economists-urge-ghana-to-treat-goldbod-as-a-strategic-policy-tool/2026/

Ghana's 'Golden' Comeback: How Global Gold pricing rise signals economic rebound through GoldBod, https://goldbod.gov.gh/ghanas-golden-comeback-how-global-gold-pricing-rise-signals-economic-rebound-through-goldbod/